To download the May 2020 Housing Aggregate PDF, click here.

.

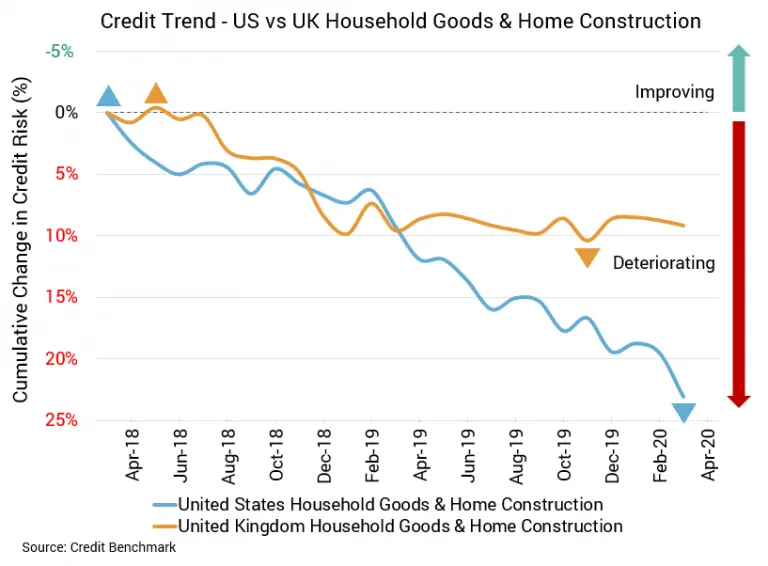

Problems in the US housing sector abound. Credit quality for both US- and UK-based firms continues to deteriorate, but the moves are significantly more dramatic in the US, with average probability of default increasing 3% over the last month and 13% over the past year.

Data is likely to be weak for some time, with April housing starts seeing a sharp fall and unemployment likely to remain elevated for months as consumers manage considerable debt burden. One estimate has US housing prices dropping until April 2021. The situation is scarcely different in the UK, with one estimate predicting a drop in prices of 13% in 2020.

Default Risk Increases 13% in Last Year for US Firms

- Credit quality for both US- and UK-based firms continues to deteriorate, but year-over-year change is far greater for US-based firms.

- Credit Benchmark Consensus (CBC) sits at bb+ for both aggregates, but continued deterioration will bring them closer to a downgrade to bb.

US Household Goods and Home Construction Firms

Credit quality for US housing sector firms took another big tumble this month. The month-over-month deterioration is 3%, and the year-over-year change is 13%. Average probability of default for these firms is currently 55 basis points, compared to 53.4 basis points in the previous month and 48.8 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) rating for this aggregate has remained at bb+ over the last year.

UK Household Goods and Home Construction Firms

Credit quality for UK housing sector firms is in something of a holding pattern: getting worse in the short-term and flat over the longer-term. The month-over-month deterioration is 0.4%, but year-over-year, this aggregate saw improvement of 0.4%. With the most recent update, average probability of default for these firms is 52.8 basis points, compared to 52.6 basis points in the prior month and 53 basis points at the same point last year. Like with the US aggregate, the current Credit Benchmark Consensus (CBC) rating for this aggregate has remained at bb+ over the last year.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.